Efficient policy administration for MGAs and insurers

Policy Manager is a purpose-built underwriting platform designed for insurers and MGAs, eliminating resource-heavy processes and costly workarounds associated with legacy systems. It provides real-time trading insights and a streamlined approach to policy management.

Developed through extensive industry collaboration, Policy Manager offers a suite of fully automated features, including:

- Pre-connected EDI integrations – Seamless connectivity with major UK broker software houses enables market-wide distribution and automated inbound/outbound policy updates.

- Agency management and financial automation – Includes policy verification, account reconciliation, and financial reporting, with configurable tolerance thresholds to maximise automation.

- Industry database integrations – Direct links to datasets such as the Motor Insurance Database (MID) ensure efficient, verified data uploads and timely recording of policyholder details.

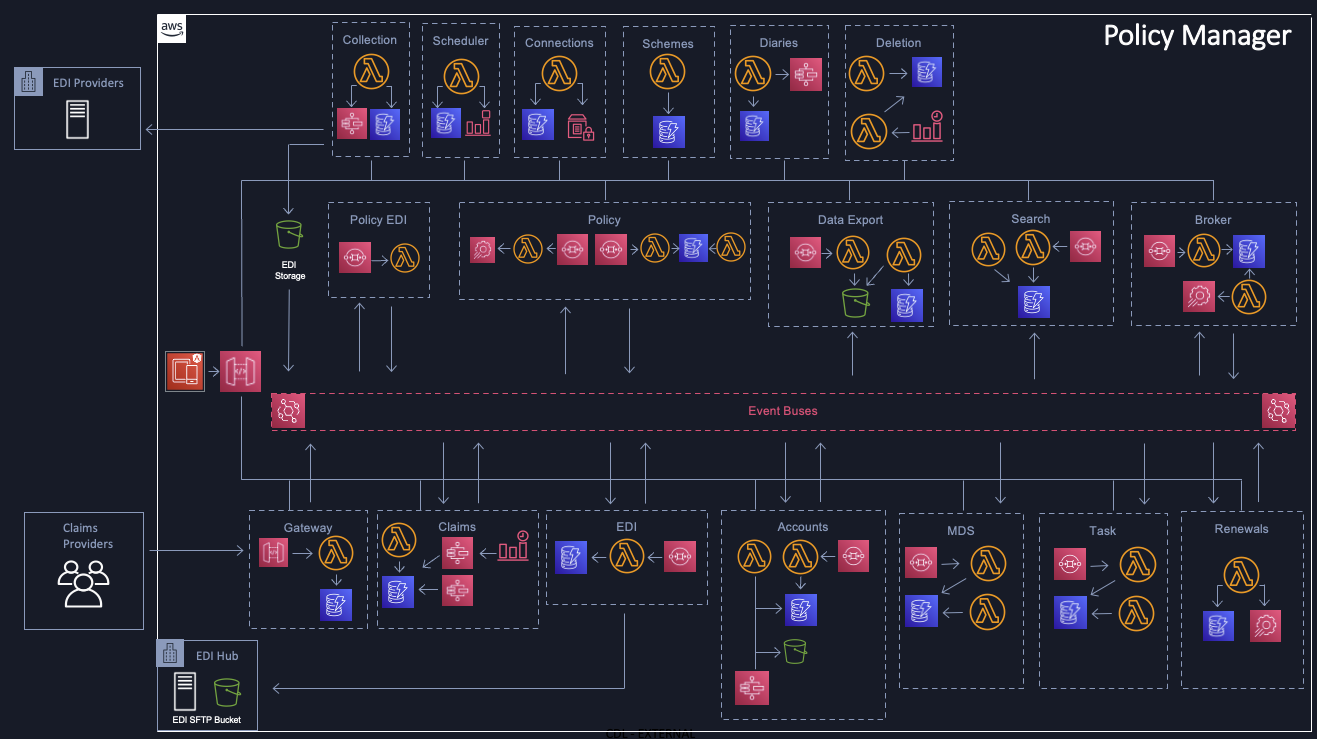

Policy Manager on AWS

Delivered as a SaaS solution on Amazon Web Services (AWS), Policy Manager leverages cloud-native architecture for resilience, scalability, and secure handling of large datasets. Key AWS components include:

- AWS Lambda for serverless execution of business logic.

- Amazon DynamoDB for configuration storage.

- Amazon Athena for advanced data queries and reporting.

- Amazon SQS for messaging and third-party submission queuing.

- Amazon S3 for storing and exporting policy data in JSON format, enabling efficient replication to user S3 accounts via Amazon SNS notifications.

- AWS Step Functions to orchestrate complex workflows, ensuring reliable execution of multi-step processes such as policy validation, data enrichment, and asynchronous integrations.

- Amazon EventBridge for event-driven architecture, enabling seamless integration with external systems and triggering workflows based on business events.

Customer Perspective

"Our MGA business has grown rapidly since we first launched Pukka and it became clear to us that we would need a new platform to meet our growth ambitions, which include adding product lines, schemes and distribution.

"We had significantly outgrown our previous back-office solution, which was necessitating too many workarounds and resource-intensive processes outside the system. As a longstanding CDL partner, we learned that CDL were developing a cloud-based MGA solution and we were really excited to have the opportunity to collaborate with them through this process and influence its design.

"The end result reflects this agile development process, based on storyboarding user needs, and it also benefits from CDL's considerable cloud capabilities; the platform is hosted on Amazon Web Services [AWS], making it incredibly fast, resilient, secure and scalable - all of which are crucial in enabling us to expand with confidence in our infrastructure."

Pukka Insure

Customer case studies

Running Policy Manager on AWS

Navigation