AWS Customer name

Cogent Insurance

APN Partner name

CDL

AWS Customer challenge

Cogent Insurance is a specialist provider of telematics insurance, using black box technology to provide car insurance based on how the customer is actually driving their vehicle. Designed to reward safer drivers and offer more affordable insurance to young drivers in particular, the telematics brands offered by Cogent include its own Yoyo Insurance and third-party brands such as Woop.

As it continues to grow and add brands to its operation, Cogent sought to bring administration in-house and move to a broker model to ensure full control of the end-to-end customer journey. It also sought an insurance retail platform that would provide a springboard to accelerate business expansion opportunities, both via price comparison websites and the launch of new products.

How AWS was leveraged as part of the solution

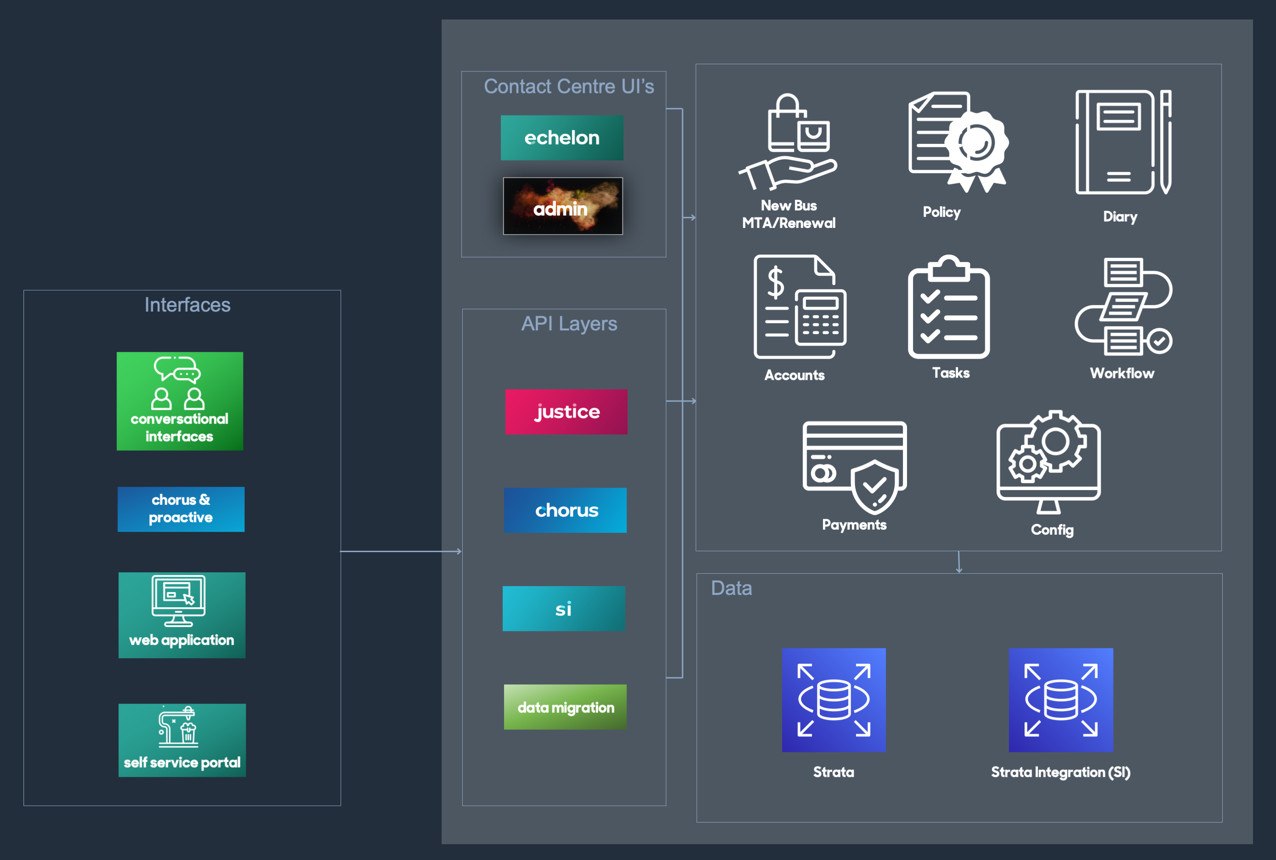

Cogent Insurance selected CDL Strata on AWS as a proven insurance retail platform that could scale with the business and offer advanced automation for connected car and home policies. With a fully integrated telematics hub, Strata ensures the sale and administration of telematics policies is automated throughout the policy lifecycle, with a rules-based engine enabling actions to be applied to the insurance policy based on driver performance.

Strata is also integrated with the aggregator hub, enabling connectivity with price comparison sites, where the majority of UK personal lines insurance is bought. This ensures insurance providers are able to bring products to market using a multi-channel strategy via a single database.

As a market leader of retail platforms in the telematics space, CDL Strata handles millions of driver data events each day, making AWS the ideal cloud-hosting platform to deliver the resilience and scalability required to handle these volumes.

CDL has a strong track record in deploying Strata on AWS and holds Differentiated Software Partner status in the Amazon Web Services (AWS) Partner Network (APN). Ways in which AWS is leveraged for Cogent Insurance include:

Outcomes

Customer view

"Launching our administration capability in-house gives us full control of our products, enabling us to be more agile in responding to changes in the marketplace, including moving to a panel model to complement our own MGA. CDL's data analytics platform has given us access to real-time business insight and this combination of data and control is key to realising our growth ambitions."

Matt Rawling, Cogent Chief Executive

Date the project entered production

February 2021

Architecture diagrams

Navigation