Hummingbird data watch

online quote manipulation in numbers

22nd January 2019

Hummingbird Syndicate is bringing together major insurance brands to benefit from sharing insights garnered using CDL's high-speed data intelligence solution and tackle the growing problem of online quote manipulation. In its first 30 days, it processed data relating to over 15 million motor insurance quotes provided by CDL customers to over 3 million consumers.

Tools to help visualise this data are revealing fascinating insights into the growing problem of quote manipulation and highlighting suspicious patterns of behaviour when generating insurance quotations. This is enabling more targeted, and therefore more effective, detection of fraud - a problem that, despite accounting for a relatively small proportion of overall sales, costs the industry huge sums every year.

Tools to help visualise this data are revealing fascinating insights into the growing problem of quote manipulation and highlighting suspicious patterns of behaviour when generating insurance quotations. This is enabling more targeted, and therefore more effective, detection of fraud - a problem that, despite accounting for a relatively small proportion of overall sales, costs the industry huge sums every year.

Manipulating data fields

With up to 90% of motor insurance sales originating online, depersonalising the process of shopping around for quotes, the inevitable temptation for people to experiment with factors that affect their premium is well documented. This is corroborated by the Hummingbird data, which shows that, on average, people request over five quotes when shopping for car insurance, although much of this activity includes consumers processing perfectly legitimate 'what if' quotations.

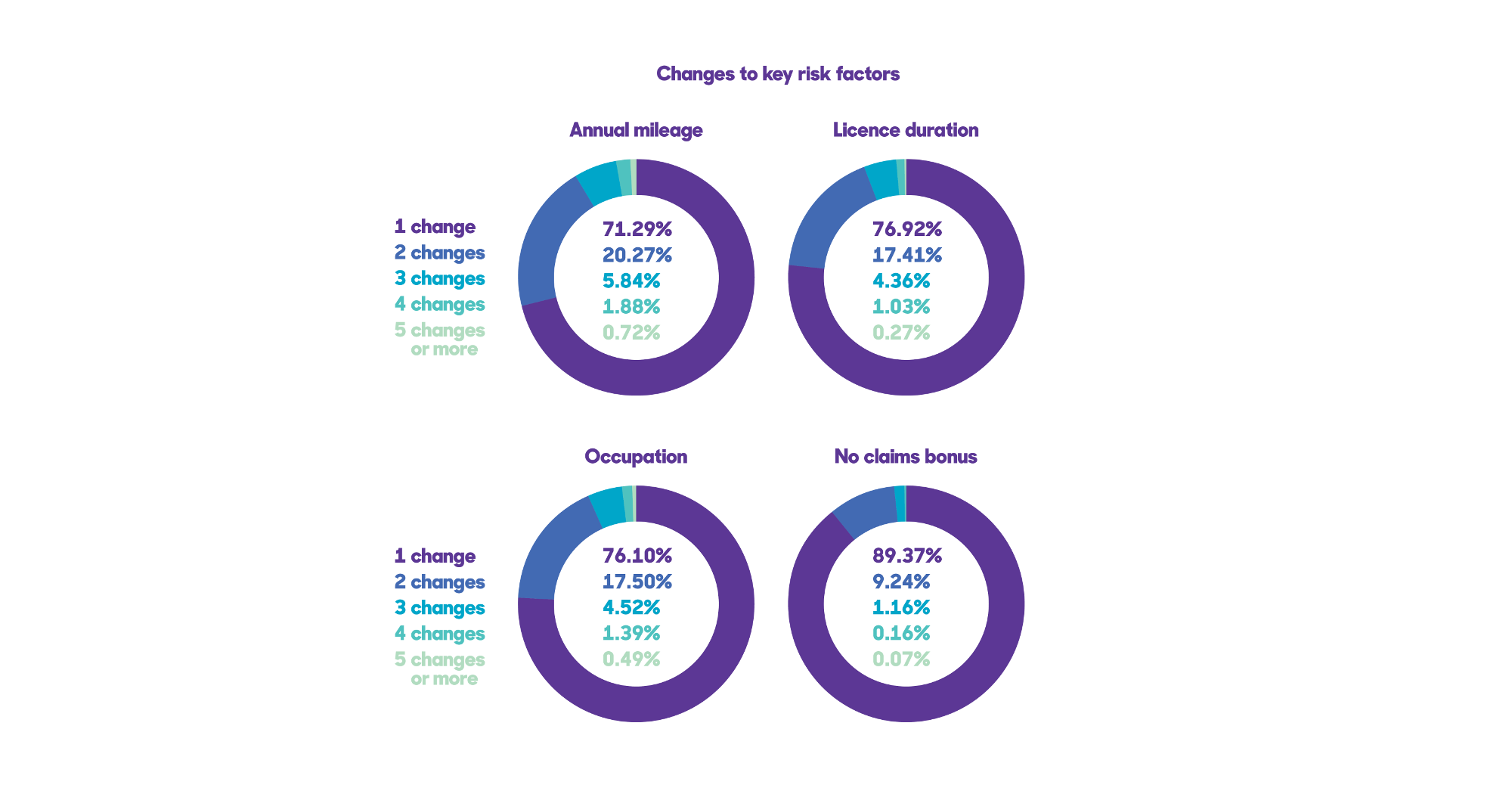

Almost half of the consumers in the sample varied at least one risk area between quotes, with the most frequently changed being 'annual mileage', altered by 27% of people. Of these, nearly a third entered two or more variables and over 5,000 people changed this value five or more times. No claims bonus changes also featured highly, with over 20,000 people making changes involving a variance of nine years. You can see why this may be suspicious, especially when multiple changes span a number of different risk factors.

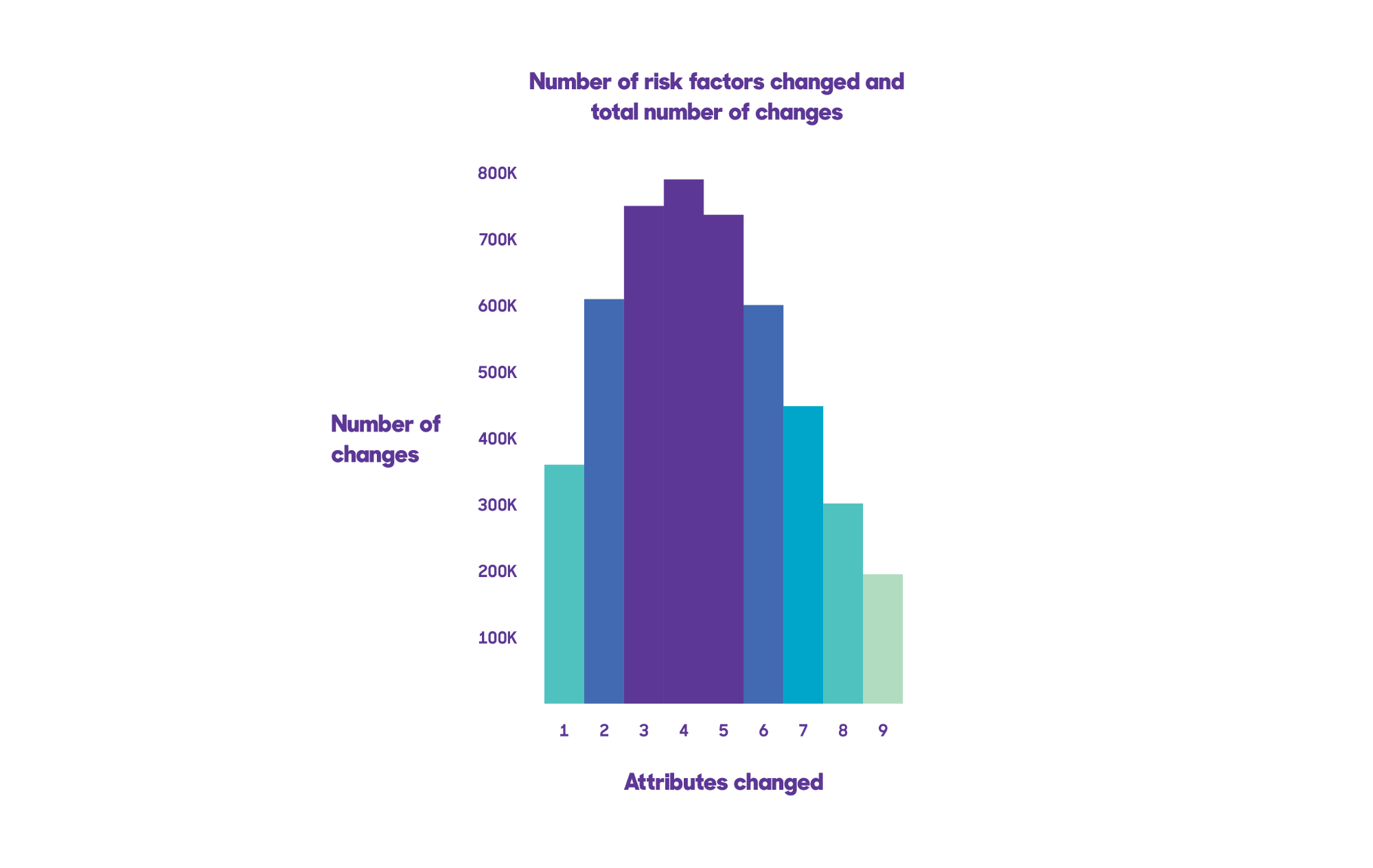

We can also see an interesting relationship between the number of different risk factors people amend when requesting multiple quotes and the overall number of individual changes they make. This peaks at four risk factors. In other words, people whose changes involved four risk factors made the highest number of overall changes.

Midnight manipulators

The data also provides insights into the times when people may be more likely to be engaging in quote manipulation. Whilst the overall peak time for requesting a motor insurance quote is 4pm, when the results are filtered to include only people who had made a significant amount of changes to their quotes, suddenly peaks in the early hours of the morning are visible.Visual analytics

Using data visualisation tools, certain patterns of behaviour become more readily apparent. For example, where changes involve the area where the vehicle is declared as being mainly kept overnight, it is possible to better understand potential hot spots using geo-mapping tools. Having identified potential anomalies, it is possible to drill down into specific postcodes and risks for further investigation.While this could, of course, be legitimate, the key for retailers is that, overall, suspicious patterns can be highlighted, creating the opportunity to react accordingly and thus avoid hefty cancellation costs.

Fronting

Effective quote matching routines are vital when it comes to detecting manipulation. Hummingbird is able to identify where people change names between quotes, which in some cases is done to avoid detection. This capability means it is also possible to detect potential instances of 'fronting'; where a consumer requests multiple quotes in different names, in an effort to obtain the lowest price. This is often done without disclosing the true main user of the vehicle, and risks invalidating their insurance policies.Actionable insights

Ultimately, it's up to Hummingbird Syndicate members how they want to use these insights. Not only does the solution aid detection of suspicious patterns of behaviour at point of quote, it enables retailers to initiate a range of actions to tackle fraud in real time, including redirecting the customer to a contact centre, flagging the quote for post-sale validation or declining to quote altogether.Retailers are able to implement their own rules using real-time pricing to determine what action to take, with factors such as the number of changes a consumer makes between quotes, the type and combination of changes and the overall volume of quotes generated being used to apply a rating to an individual. They may also decide that changes to certain unvarying data fields, such as insurance refusals, will automatically result in a quote being denied or flagged for post-sale validation.

Two years on from its launch, Hummingbird is continuing to deliver real business benefits for customers, providing invaluable insight at point of pre-quotation. Hummingbird Syndicate is building on this by enabling the industry to collaborate and tackle head on what has become an increasingly challenging issue.

© 2026 Cheshire Datasystems Limited

Top Employer