CDL goes live with new service delivery solution

CDL has gone live with market leading service management solution, ServiceNow, to more efficiently meet customer service requirements and enhance its continuous service improvement programme.

ServiceNow will provide CDL and its customers 24/7 access to a live service portal, which includes access to real-time information and provides an instant picture of what is happening, removing the need to contact the CDL Service Desk for routine updates.

The lightweight, browser-based interface enables the CDL service management team to manage incidents, problems, configuration and change, more efficiently. This will be followed by additional release, capacity and availability management capability.

ServiceNow also eliminates much of the manual administration involved in the customer support process, which will assist CDL in improving service in other areas such as providing customer reports and trend analysis into causes of incidents being logged, and identifying training needs.

The ServiceNow Software as a Service (SaaS) platform was designed and built to support ITIL, the service management best practice methodology employed by CDL.

Clive Simpson, Head of Service Management at CDL, commented: "The ServiceNow launch marks another significant milestone in CDL's commitment to continual service improvement.

"Our investment in this leading system will assist us greatly in serving our customers by providing greater transparency and enabling faster resolution of issues. The new platform opens up a huge range of possibilities, and we look forward to further exploiting ServiceNow's full potential in the near future."

Michael Lambert appointed Head of Development at CDL

CDL has promoted Michael Lambert to the post of Head of Development. In his new role, Michael will be responsible for increasing the development capabilities around CDL's ever expanding product range and delivering software that enhances the consumer experience and retailer efficiency.

Michael joined CDL in 2005 and has made a significant contribution to the company's agile approach to software development, most recently, in his post as Developer Manager.

Gary Johnson, CDL Group Director, said: "Michael has brought a wealth of ideas to our working culture, especially in our adoption of agile, which has helped us streamline our development cycles, increase the frequency of releases and ultimately deliver more value to our customers through high quality software development.

"In his new role as Head of Development, I'm confident that Michael will further bolster the Development team and strengthen our capability as we continue to expand our footprint in the InsurTech marketplace."

Michael Lambert added: "This is a very exciting time to be taking the reins as Head of Development. CDL is continuing to spearhead innovation through powerful data solutions and new consumer interfaces that reflect the way people want to shop and communicate. I look forward to providing the leadership and support our squads need to continue to develop world-class software through an increasingly collaborative and productive working environment."

How AI will revolutionise the way insurance is bought and sold

AI is here to stay, with many insurers and brokers exploring the potential for the technology to boost efficiency, accuracy and productivity. While recent reports suggest that the UK is lagging behind the rest of the world in assessing the impact AI will have on businesses, insurers appear to be shedding their reputation for being slow to embrace change, with 75% planning and preparing for disruption from artificial intelligence over the next five years.

But how will AI change the way insurance is bought and sold, what benefits will it bring consumers and retailers, and what will this mean for the future of the industry?

A tailored quote

One cornerstone of AI, machine learning, can help retailers to learn more about their customers and use this knowledge to price preferentially and fight fraud. Also known as 'pattern recognition', machine learning uses data from numerous sources (whether big data, speech or image recognition) to identify recurring patterns or unknown patterns in order to make predictions or decisions.

Machine learning has the potential to be fantastically useful to insurance retailers who have access to a bank of consumer data. Using this big data, machine learning can assist retailers in learning more about customer habits, behavioral patterns and preferences when shopping for insurance.

When combined, big data and machine learning algorithms can be used not only to make recommendations to customers and return responses to enquiries that are more relevant to an individual's interests, but to provide a quote tailored to each customer by AI-adjusted pricing; whether priced preferentially or more reflective of an applicant's history of risk. Big data, machine learning and analytics technology forms the basis of CDL's cloud-based Hummingbird data intelligence solution, which is able to process vast volumes of data from unlimited sources at sub-second speed to offer unrivalled customer insights and inform pricing at point-of-quote.

A personal insurance shopper

Advances in artificial intelligence have improved the ability of chatbots to learn and communicate effectively during customer interactions. Away from their established role as intelligent, pre-programmed customer service agents, chatbots offer a real opportunity for retailers to shift the insurance shopping experience to a more consumer-centric focus.

The predictive nature of chatbots shortens the customer journey through reducing the number of input fields and guiding the customer through the process with casual, conversational language.

As covered in this issue's software update, CDL's Jay is able to generate a quote via the customer's smartphone through a short conversation with a chatbot. Jay's sleek interface and conversational style not only offers a convenient, accessible route for customers to purchase car or home insurance, but gives customers a more exciting way to engage with insurance products.

Your insurance in pictures

Once a retailer is able to provide tailored premiums, what is the best way to further personalise the insurance shopping experience? Image recognition, a technology that enables AI to identify and understand the content of static digital images, could be the next step in this regard.

Image recognition AI is trained using massive amounts of labelled data to enable it to classify images by content, and it does this very well. Human beings are able to correctly label an image 95% of the time. In 2015, an AI surpassed this rate and correctly identified 96% of images.

Beyond drawing information for input fields from an image, image recognition may be used to provide item-by-item cover or evidence for future claims against contents insurance.

One size does not fit all

PWC's Global FinTech Survey reported that almost three quarters of insurers saw the most important impact to business from FinTech and related technologies as the need to 'meet changing customer needs with a new offering'. In today's digital landscape, one size no longer fits all and customers have come to expect ever more personalised solutions for their financial services.

Advances in AI and data have paved the way for this personalisation to become achievable. Through a combination of machine learning, conversational interfaces and reducing the amount of inputted data using technologies such as image recognition, AI gives choice back to the consumer while both streamlining the insurance shopping process and boosting efficiency for retailers.

Ian Hughes on making technology work for the customer

Ian Hughes is Chief Executive at Consumer Intelligence, a boutique research consultancy that helps companies view their services through the lens of the consumer. Here, Ian shares the truths at the heart of using technology to build a beautiful customer journey.

A superior experience. An engaging brand. A seamless journey. These are things most insurance retailers work to provide in their service offering. Technology is key to achieving these aims, yet many retailers miss out on the opportunity to take a step back and evaluate their digital offering through the eyes of the consumer.

A shift in focus

Insurance retailers and consumers approach technology from very different perspectives. For customers, the value of technology is not in its cost effectiveness, but in the opportunities it opens up for engagement and experience.

Previously, the insurance arms race was based on who had the best technology. The focus has shifted to tailoring tech, service and experience to be congruent with an insurance retailer's brand.

Context comfortable technology

While the appetite for the latest technology is there, it's again a matter of understanding customer perspectives. It's important to bear in mind that technology advances at a rapid pace, and with this progression comes changes in perception. Technology that was 'ok' last year is likely to be unacceptable by today's service standards.

Technology must be context comfortable. A millennial may not have any qualms about passing on data to an insurance retailer in exchange for rewards or discounts on their policy, but on the other hand, older generations may be suspicious about giving away their data.

Simply put, different technology works for different people. With this in mind, insurance retailers need to offer services across multi-channels to increase choices for consumers, whether phone, online or via webchat. Even a tech native may prefer to complete their purchasing journey over the phone if they have run into a snag while trying to purchase their insurance online.

Most importantly, each service and journey must be delivered well and consistently across channels. If the purchasing journey is fraught with obstacles, whether these are encountered online or via the contact centre, it can be incredibly damaging for the customer's experience.

The value of measurement

Measurement is key to successful retail business, and one of the best things about technology is that it enables everything to be measured. The data collected as standard during the insurance shopping journey opens up a range of possibilities for retailers to better understand the customer experience.

For example, retailers can learn at which stage customers drop out of the quote journey, where they are asking for further information or clarification, which fields pose an obstacle to journey completion and so on.

Insurance retailers will find real value in looking at analytics, as it can really highlight the obstacles standing in the way of a streamlined customer experience. The data is readily available, as are the analytical tools, yet many insurance retailers miss out on this incredible opportunity to engineer a beautiful customer journey.

Looking ahead

Fast forward into the future, and we can expect experience to be at the heart of all services. Knowing your customer, being able to see the world through the eyes of your service users and understanding what makes a smooth customer journey will be absolutely vital in the years to come.

Technology enables insurance retailers to achieve this, whether through crafting the perfect customer journey, simplifying the renewals process or building the optimum brand experience and engagement platform.

Pukka Commercial Vehicle Insurance

Policy Type:

Commercial vehicle

Scheme Name:

Pukka CV

Scheme Code:

PA

Company Code:

PA

Pukka Insure Limited is delighted to announce that its Commercial Vehicle Insurance product is now visible to all CDL brokers.

Brokers can now view Pukka quotes by adding the Pukka CV product to their quote list, scheme code PA.

Designed for commercial vehicles based in the UK (excluding Northern Ireland and the Channel Islands), the product offers Comprehensive or Third Party Fire and Theft cover for vans up to £50,000 in value, with flexible excess options to suit the customer.

Cover is available for vans with various types of modification, such as signwriting or internal racking.

Underwriting Philosophy

Whereas some insurers may decline cover altogether due to a conviction or claim, Pukka has a dedicated underwriting team with the expertise to look more closely at a customer's driving history. Pukka has a particularly in-depth understanding of the market for drivers with previous claims or convictions and is able to give special consideration to drivers who have taken positive action to improve their risk profile since the accident or conviction occurred.

This translates into clear advantages for both the broker and the customer, as Pukka is often able to offer extremely competitive premiums in this area.

To find out more about applying for an agency with Pukka, email enquiries@pukka.co.uk or call 0800 240 4991.

Aviva Multi-Vehicle cover launches on CDL

Policy Type:

Personal Motor

Scheme Name:

Aviva Car & Aviva Van

Scheme Code:

RH & VA***

Company Code:

NU

Available on CDL Classic and Strata

Flexibility, individuality, savings - bring the whole family together

We're pleased to share the good news that Aviva's new Personal Lines multi-vehicle cover is now available to you.

It's a proposition that allows you to reward customer loyalty in households that are covering multiple vehicles, while still treating each family member as an individual, with their own policy, excess and no claims discount. And the more vehicles each household insures with Aviva, the more discounts you can give - up to 15%* per vehicle. All with no change to your existing processes, as discounts are automatically applied by our rating hub.

Multi-vehicle cover, multiple benefits

- Offer up to 15%* discount for each vehicle covered

- Separate policies, excesses and no claims discount

- No limit to the number of policies per household

- First vehicle discount offered**

- Discounts automatically applied with no change to your processes.

All in all, it's a great way to attract new customers and reward loyalty in existing ones. For multi-vehicle cover that's altogether better, contact your Aviva sales manager.

* Subject to minimum premium

** If other vehicles are insured elsewhere, customers get the first vehicle discount for the first year and ongoing if a second vehicle moves to Aviva.

*** Aviva Van coming soon.

60 Second Interview

Name: Paul Muir

Job Title: CEO - oneanswer Insurance / Chairman - 1 Answer Network

How did you get into insurance?

My journey into insurance started by complete accident when I was asked to make up a four in a game of badminton with some ladies. One of them was married to an insurance broker, who in turn offered me a job as an office junior in London.

What you love about it?

I love the lifetime friendships I have made with some insurers, software house personnel and brokers, and the feeling of satisfaction when you have ideas that you can explore and develop within the industry with friends and business acquaintances.

What you hate about it?

I don't hate anything about it really - just some of the challenges that seem nonsensical when you have to script everything nowadays and bombard your clients with paperwork, so you lose some of the personality whilst accepting that this is now a vital part of TCF.

Best professional achievement?

Starting a brokerage business from scratch with me, a PC and a phone. Then of course writing a business plan and getting complete buy-in and support from CDL and others for my network, designed to help fellow brokers run their businesses on a more level playing field.

Biggest challenge facing the sector?

I would say there are plenty of challenges, but adapting to the buying habits and enquiring habits of clients is both a massive challenge and opportunity

Biggest opportunity?

To diversify and be different, offering business classes that are not click through and need intervention, conversation and advice. I have to say that CDL systems are fantastic in supporting this for us.

Which gadget could you not live without?

No shock here, iPhone of course!

Football team?

The mighty CRYSTAL PALACE! I have followed them as my local club through thin and thinner, but love them for what they are: MY CLUB.

Desert island discs?

- Blur - The Universal

- Kraftwerk - Neon Lights

- Human League - Dare (the album - it is a disc after all!)

Biggest vice?

Sitting and suddenly thinking "I've had an idea" - business plans, logo design and URL purchased!! I have far too many…

How do you unwind at weekends?

If I am at home a good long walk over the Sussex Downs (to think of new ideas!) or - if on holiday - a good book...

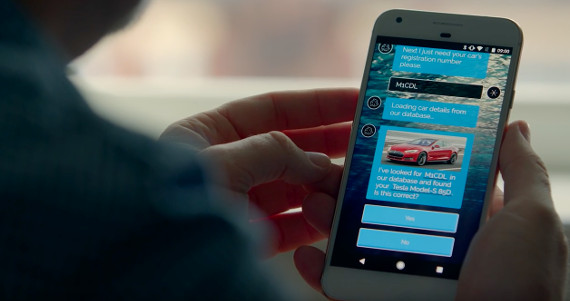

Introducing Jay, a new way to engage with consumers

CDL is developing Jay, a new chatbot-styled interface which enables customers to generate car and home insurance quotes through their smartphones.

The rise of chatbots is emerging as the latest trend to transform the customer service industry through 24/7 access and quick, efficient responses to consumer enquiries, from checking your bank balance to booking a table at Pizza Express.

But what if a chatbot could be used to meet the changing needs of insurance customers, guiding them through the insurance shopping journey and removing the burden of onerous question sets, which are typically required to generate a quote?

Meet Jay, the latest development in CDL's range of mobile solutions. Jay is a chatbot-styled interface that generates a car or home insurance quote based on the content of a customer's conversation.

With a simple mobile interface, Jay is inspired by chat apps such as WhatsApp, and uses AI technology to move away from lengthy insurance shopping processes to streamline the customer journey and make insurance more accessible.

Image recognition technology opens up a range of possibilities to further shorten the customer journey, and Jay is capable of drawing information from any smartphone-snapped photograph, whether of a driving licence, a car or even the family pet, to automatically prepopulate input fields.

Andrew Wormleighton, Director of Software and Technology at CDL, commented: "Jay is one of many exciting ways in which we are reinventing the insurance shopping experience to be more consumer-centric. By combining AI, image recognition and big data, Jay marks a step change in the way customers interact with insurance, while at the same time enhancing operational efficiency for retailers."

For more information on CDL's mobile solutions, please speak to your Customer Relationship Manager.